A part out of Veterans Items (VA) cash-aside home mortgage refinance loan also provides people money in change due to their domestic guarantee. As you might imagine, it is a handy unit by which experts and military service users have access to financing otherwise capital with the-request.

What exactly is An effective Va Cash-Aside Re-finance?

A great Va cash-aside refinance, otherwise refi, allows pros, active obligation servicemembers, participants, and you will surviving spouses who qualify, locate a loan for up to 100% of appraised worth of their house.

Funds received toward Va system are often used to shell out from liens and you may loans, make home improvements, or made use of in an effort to refinance a low-Va loan toward a great Va mortgage (which comes with best terminology affixed than simply a normal mortgage).

Essentially, an effective loans Old Hill Va bucks-away refinance mortgage makes you change your newest mortgage which have a national-recognized financing, or transfer family collateral toward bucks and implement which dollars for the paying other expenses.

Just like the Virtual assistant money was supported by the us government, such money present straight down overall chance so you’re able to loan providers. This means that individuals just who see loans using these types of software is also access resource significantly less than significantly more beneficial loan words.

The whole process of trying to get good Virtual assistant bucks-out loan is much like regarding applying for a normal loan. They begins by the researching loan providers, reviewing loan conditions, and you can just after comparing for every single lender’s terms and conditions looking for a financial institution to utilize, following distribution a loan application.

Who’s Entitled to A great Virtual assistant Bucks-Aside Re-finance?

For example, you don’t need to currently keep an effective Va financing to access the program. Irrespective of any type of kind of conventional financial (15-season, 30-year, adjustable-rate (ARM), etc.) you’ve got, it’s possible to availability funding for an effective Virtual assistant bucks-away loan.

However, you will do must be qualified to receive the application form and only particular somebody qualify. To meet minimal requirements had a need to see a good Va financing, applicants must have:

- Served toward energetic responsibility to have a minimum of twenty four persisted days, otherwise mobilized getting 90 days

- Mobilized ahead of August step one, 1990 for around 181 months

- Given 6 many years of creditable provider about Reserves otherwise National Guard or at least ninety days significantly less than Label 10 otherwise Title thirty two , which have about 29 being straight

- Services date standards may be waived if perhaps you were medically discharged

- Come brand new enduring partner out of a service associate just who passed away from inside the the line of obligation

So you can open accessibility Virtual assistant loan experts, you’ll need to furnish your lender with a copy away from good Agency from Experienced Facts Certification out of Qualification (COE), hence verifies that you have came across the minimum criteria necessary to qualify for the borrowed funds. Any applying experts and you may servicemembers need started discharged under honorable conditions.

To qualify to alter the quantity of your residence collateral into bucks, you’ll need to meet up with the individual lenders’ minimum credit history criteria and criteria for loans-to-earnings percentages (DTIs). On top of that, your house that you’re refinancing must also end up being your primary household.

To alter your own overall domestic guarantee on the dollars with Rocket Mortgage you truly need to have the absolute minimum credit score regarding 680. If for example the credit history is below 680, you could only cash out ninety% of your house’s guarantee.

Virtual assistant Dollars-Away Re-finance Rates Compared to. Important Dollars-Away Re-finance Pricing

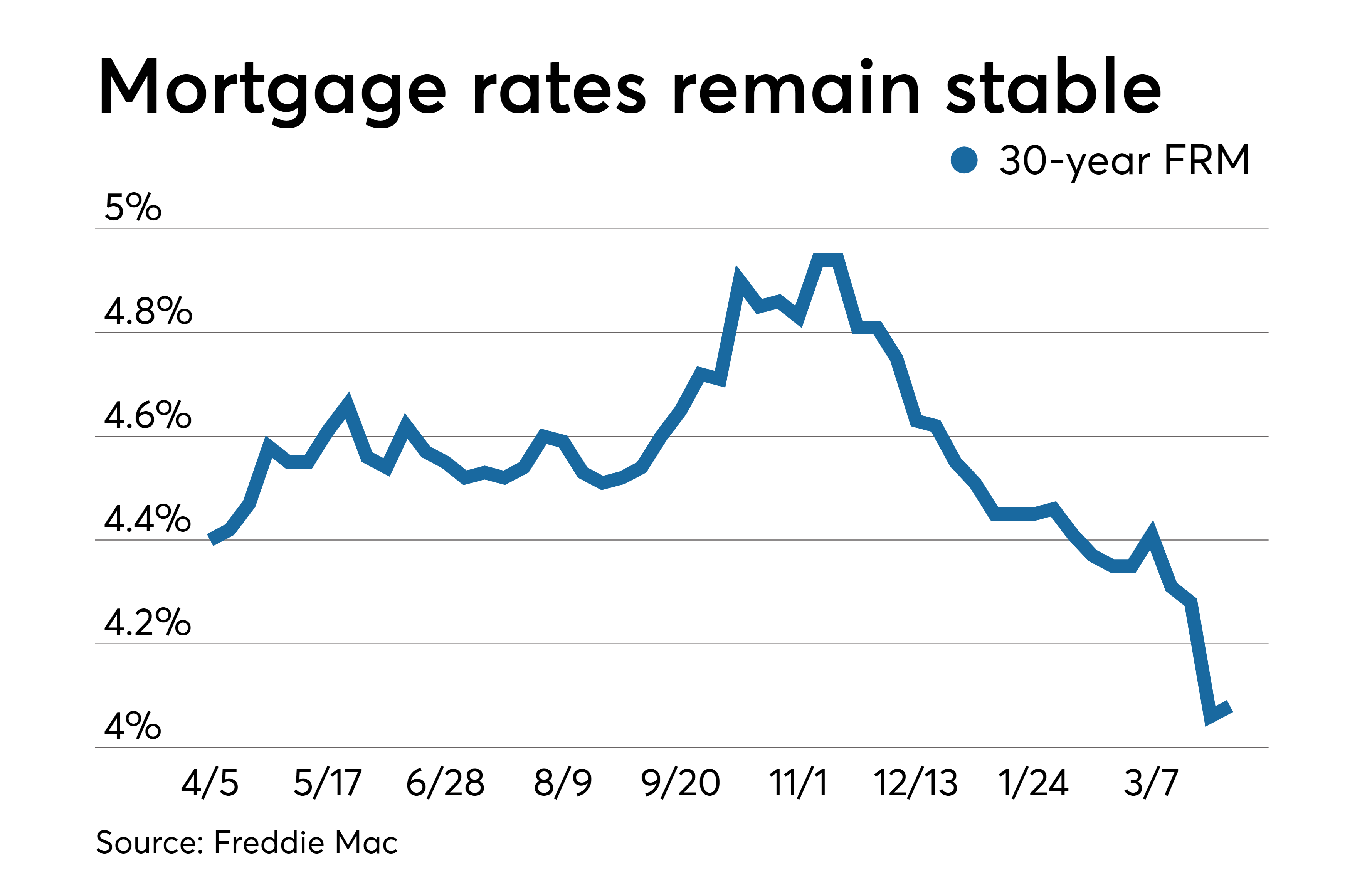

Supported by the fresh new Agencies out of Experts Factors, Va bucks-out refinances are believed less risky of the lenders. Because of this, rates are generally below he could be for money-away refinances towards the old-fashioned lenders. Make sure you here are a few today’s home loan rates to find the current suggestions.

Y et will additionally be responsible for settlement costs (prominent expenditures paid for home financing, such as for example appraisal fees, mortgage origination costs, identity insurance coverage, etc.) at the time you romantic towards an effective Va cash-aside refinance. It is possible to be asked to pay an excellent Virtual assistant dollars-refinancing commission.